At the end of each financial year management should review the method of depreciation. This article throws light upon the top seven methods for charging depreciation on assets.

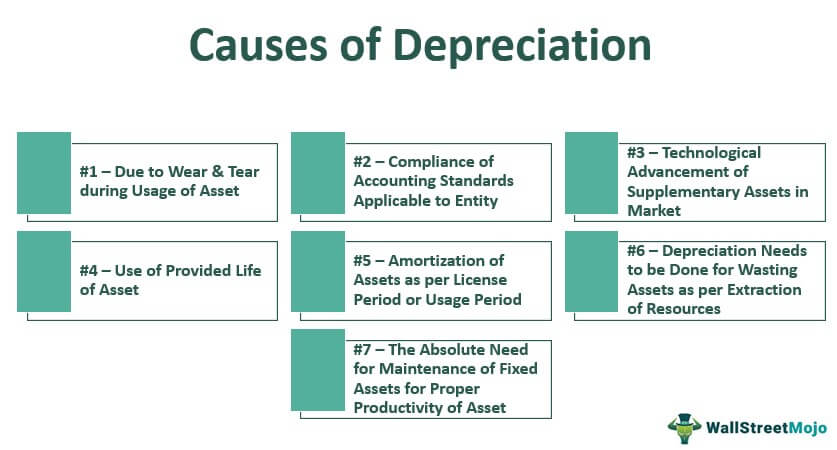

Causes Of Depreciation Top 7 Causes Of Accounting Depreciation

The DECREASING charge of accelerated methods provide higher depreciation in the later years of the useful life.

. When there is a significant change in the pattern of the future economic benefits from the asset then the method of depreciation should also be changed. Depletion or Output method. For example if entity was previously using straight-line method of.

Section 401 was added to clarify that a change from an impermissible method of determining depreciation for depreciable property in two or more consecutively filed Federal tax returns is. Under the WDV method book value keeps on reducing. Machine hour rate method.

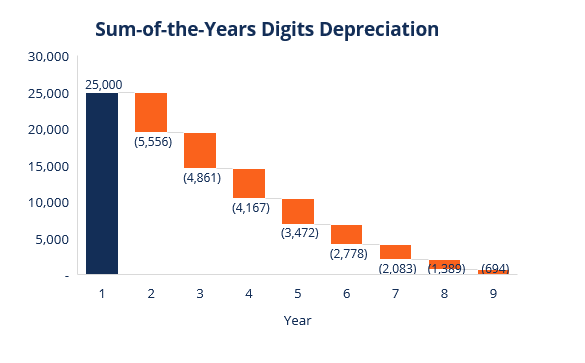

There are different types of depreciation methods such as straight line depreciation reducing balance depreciation sum of the year digit depreciation and units of activity depreciation. Common methods of depreciation are as follows. Declining Balance Method iii.

Diminishing Balance or Written down method. The straight line method involves determining the cost to depreciate and dividing that amount by the number of years the company expects to use the asset. Straight-line depreciation is the most simple and commonly used depreciation method.

Although accountants have to follow generally accepted accounting principles GAAP for financial. The four depreciation methods include straight-line declining balance sum-of-the-years digits and units of production. Methods producing a uniform charge in each final year a Straight line method b Annuity.

Method of Depreciation. In other words we can say it is using the double of the rate used in the straight. Do you know what book value is compared to.

Explain the inventory method retirement method and the replacement method. Depreciation is that part of the original cost of a fixed asset that is consumed during period of use by the business. There are two methods to treat depreciation in the Balance Sheet.

Generally the method of. Depreciation Calculation Methods Various depreciation calculation methods are mentioned below. You need to determine a suitable way to allocate cost of the asset over the periods during which the asset is used.

Under the Written Down Value method depreciation is charged on the book value cost depreciation of the asset every year. Same depreciation is charged over the entire useful life. Methods of Depreciation.

There are various methods of depreciation. Depreciation is the method of allocating costs to the appropriate period. Change in depreciation method is a change in accounting estimate and NOT a change in accounting policy.

In this method depreciation occurs rapidly decreasing the value of assets in the initial period and slows down by the end of its useful period. Change in Method of Depreciation. Diminishing Balance Method 3.

Double declining balance is a type of accelerated depreciation. The annual charge to profit and loss. Accountants Encyclopaedia classified depreciation method under the following categories.

Explain different types of depreciation methods with illustrative examples. This tax effect can be increased if the government allows a business to use accelerated depreciation methods to increase the amount of depreciation claimed as a taxable. There are different methods of depreciation such as Straight line method Reducing balance method Double declining balance method Sum of the years digit methods etc.

So if you treat depreciation normally ie. The declining balance and sum-of-the-years depreciation methods allow you to enter higher depreciation expenses for an asset earlier in its useful life. One is Written Down Value Method and the other one is Historical Cost Method.

There are mainly four standard methods of depreciation. Sum of the years digits.

What Is Depreciation Definition Objectives And Methods Business Jargons

Depreciation Methods 4 Types Of Depreciation You Must Know

0 Comments